Amazon Prime Day For Sellers: New Insights For More Sales

Amazon Prime Day 2023 (July 11-12, 2023) is quickly approaching, presenting a unique opportunity for brands to drive more sales, connect with customers, and give their brand an overall lift.

But a question arises when considering Prime Day sales by brands: does participating in Prime Day actually provide brands with a performance lift? In other words, is it worth being part of Prime Day for businesses?

That’s what we set out to find out.

Gen3 Marketing gauged Prime Day performance from 2022 to understand whether participating brands saw a lift in performance compared to those who did not.

Our research revealed some surprising insights.

Background: Benchmark Methodology

To determine whether participating in Prime Day provides brands with a performance lift, we examined brands who did participate and brands who chose not to participate in Prime Day 2022 (July 12 – 13).

We compared both YoY (6/21/21 – 6/22/21) and PoP (7/5/22 – 7/6/22) results.

Participation in Prime Day was based on the brand having a promotion that was added to a commercial plan with the intention to compete/capitalize on the wholesaler’s promotional activity.

- Revenue

- Clicks

- Orders

- Average Order Value (AOV)

- Conversion Rate (CVR)

Performance Across All Verticals

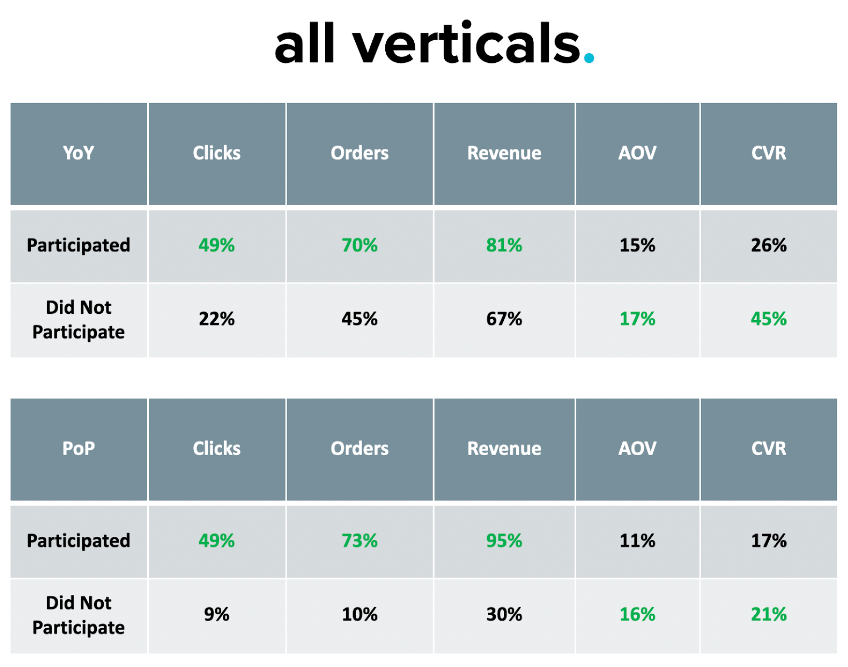

Our research reveals that brands that had a competing offer during Prime Day last year saw a greater lift in performance across clicks, orders, and revenue both YoY and PoP.

It was interesting to note how the surges of traffic influenced AOV and CVR.

The lift in AOV was higher on average for brands that did not participate. This aligns with what we would expect, given those who did participate had very competitive promotions, which would drive down basket size and total order value. In other words, promotions resulted in lower product prices, resulting in lower AOV for brands participating in Prime Day.

CVR lift was also stronger for those who did not participate. Why? It was primarily a result of clicks growing more rapidly for those who did participate – a trend that could have been impacted by the assumed research customers were completing on their side.

Or, to put it another way, there was a surge in customers clicking on all participating brands on Prime Day because they were doing research into the various promotions being offered.

The performance data for all verticals can be seen below:

Ready to raise your ROAS? Let’s talk about how to drive exponential returns with your affiliate program

Performance In Fashion Accessories

- 50% off sitewide

- 20% off regular + 60% off sale

- 40-60% off everything

- Flash Sale! Up to 60% off select styles

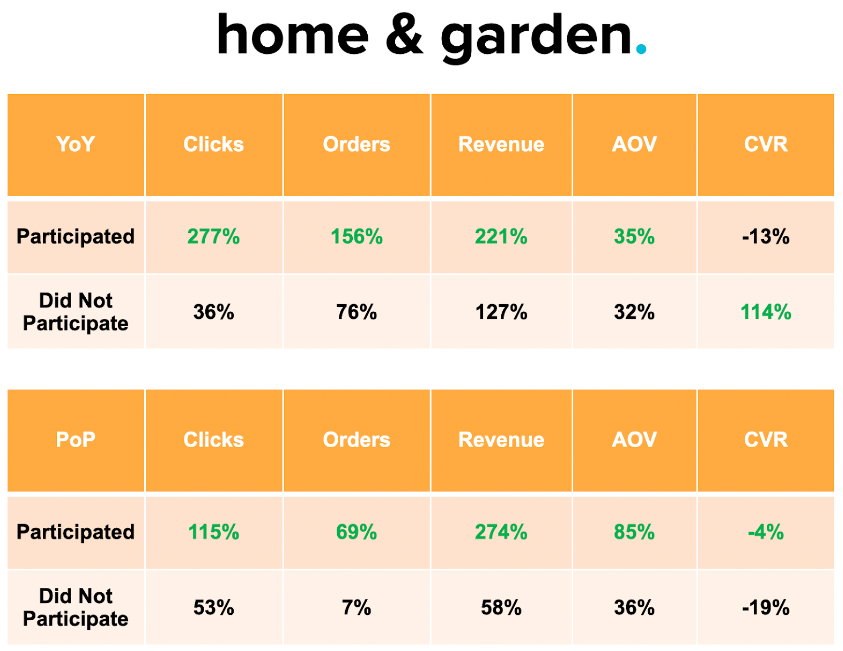

Performance In Home & Garden

The Home & Garden vertical saw strong performance across all KPIs, both YoY and PoP. Note that click growth was in the triple digits, which negatively impacted CVR. Consumers showed intent within this category, but given the assumed price point competitiveness on Amazon, participating brands had a challenge getting consumers to convert directly.

Top offers included:

- Additional 15% off

- Up to 50% off select styles

The performance data for the Home & Garden show the growth of those who participated in Prime Day compared to those who did not.

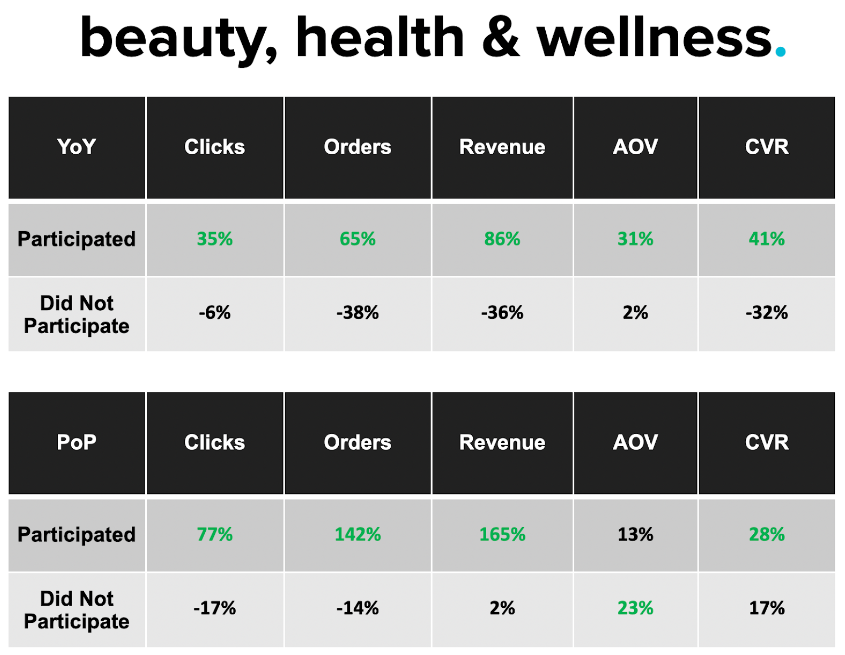

Beauty, Health & Wellness

Like Home & Garden, all KPIs in Beauty, Healthy, & Wellness saw strong YoY and PoP growth for participating brands. Those who did not participate saw declines in both orders and clicks across the two comparison periods. Home & Garden and Health & Beauty, along with electronics, were among the top-performing categories last year.

Top offers included:

- 20% off sitewide with code

- 30% off sitewide

- 50% off everything

The performance data for the Beauty, Health, & Wellness vertical can be seen below:

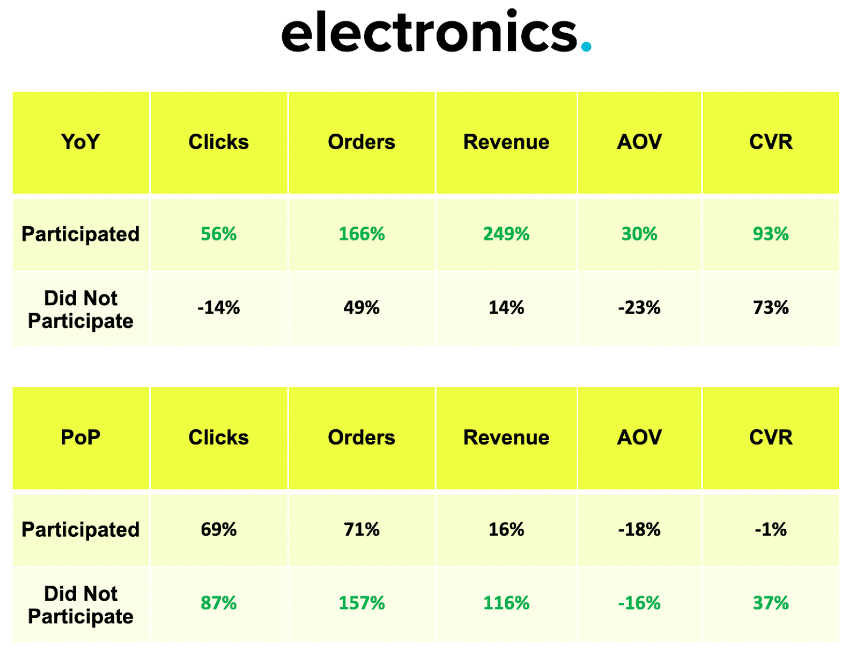

Electronics

The electronic vertical saw strong performance PoP regardless of participation, which could result from the category itself being the top sourced category during the last two-day event. CVR did drop PoP for those who participated – a trend we saw across most categories.

YoY, the category saw significant growth, and it was reported that Prime Day did grow in sales figures YoY, but as a result of higher ticketed items being sold, including TVs and Home Entertainment (supported by the YoY growth in AOV this vertical saw).

Top offers included:

- 25% off $150

- $110 off top-selling item

- 50% off everything

The performance data for the Electronics vertical can be seen below:

Key Industry Takeaways From Amazon Prime Day

Some key industry takeaways from Amazon Prime Day 2022 include:

- 62% of consumers ONLY made a purchase on Amazon during the event – a very high percentage which indicates consumers aren’t yet considering other retailer options during this time period.

- Last year, inflation played a significant role in Prime Day performance (65% saying they spent the same or less compared to 2021).

- Top categories sold last year were Household Essentials, Health and Beauty, and Consumer Electronics – Apparel & Shoes taking fourth place

- Within affiliate, partners were recording record sales figures; however, noting that the YoY increases were primarily a result Kitchen and Grocery, TVs and Home Entertainment, Phones, Cameras, and Accessories all seeing strong growth.

Early Read On Prime Day 2023

So what should retailers expect on Prime Day 2023?

Clothing/Apparel Surge

Sellers should expect a surge in clothing and apparel sales. Many clothing/apparel categories have overstocked in this category because of macroeconomic reasons with the economy slowing down.

Early Shopping Behavior

Promotions are starting early. Brands are looking to capitalize on the discovery phase of the buyer’s journey before their focus shifts to Amazon. This halo effect was actualized in 2022, with sales growing 67% YoY the day before Amazon’s two-day event.

Offer Competitiveness

There are early indications of cashback offers ranging from 10%-16% site-wide, and offers ranging from an extra 25% off, up to an extra 60% off, and 10% off $100 omni offers.

Top Predicted Categories

While we obviously cannot know exactly how Prime Day 2023 will unfold, here are our top predicted categories:

- Beauty and Personal Care

- Clothes, Shoes, and Accessories

- Electronics

- Cleaning Supplies

- All Natural and Organic Products

- Grocery

- Beer, Wine, and Spirits

- Movies, Music, and Books

- Video Games

- Health and Wellness

Next Steps

So what are the next steps for Amazon sellers to prepare for Prime Day 2023? Here are a few we recommend:

- Bake in a competitive offer that mirrors Amazon pricing, including free or expedited shipping.

- Start early to capitalize on the discovery phase of the buyer’s journey and to get ahead of those preparing for Back to School.

- Lock in added coverage to amplify promotional messaging further.

- Compete with cash back! Consider leveraging loyalty partners to compete with Amazon when there are product margin limitations to be mindful of.

- Source opportunities with content commerce partners to ensure a brand presence on sites participating in Prime Day chatter early.

Want to go further with your affiliate marketing program? Talk with us today!

More Blogs

Active vs Passive Rewards Programs: What Brands Need to Know

Learn about “click-to-activate” and “always-on” rewards programs. Find out what they do to amplify and accelerate affiliate program success.When I think about rewards programs, I’m brought back to shopping with my mother in the ‘90s. She had a wallet full of...

Partnership Marketing: The Ultimate Guide

Partnership marketing is reshaping how brands scale reach, trust, and revenue. In this guide, we break down why it works, how to leverage it, and how to get it right.Partnership marketing has been a tactic since the rise of the internet and ecommerce in the late...

Affiliate Resilience: Thriving in an Economic Downturn

Affiliate investment is among the strongest ways to grow your business during uncertain times. Learn why the affiliate channel excels during an economic downturn or recession.As the economy contracts and businesses reassess marketing spend, affiliate marketing becomes...

By

By